Our Technology

The modelling framework and technology underpinning our analytics.

The modelling framework behind better allocation decisions

Allocation Strategy's core modelling engine integrates every step of the asset allocation process, and underpins the Analytics Stack we provide to institutional investors.

Our "AS Asset Market and Macro Model" (ASAMM) framework contains proprietary models that are used to understand what is priced into markets in terms of macro expectations and risk. Through use of a unified modelling framework, all of our analytics are integrated and consistent. This gives investors forward-looking, market-consistent insights, which are robustly defined across asset classes, geographies, and time horizons.

The framework builds on decades of applied and academic research, extensive real-world deployment, and in-house R&D. A key aspect of all models is the use of present-value relationships. This approach allows us to generate expectations and macro risk factors that are consistent with the market consensus pricing.

An intuitive understanding of markets and asset allocation

The ASAMM framework models the market consensus on macro drivers across horizons, every day. This macro present value approach identifies what is priced into markets, across asset classes. When viewing markets this way, we can develop powerful and intuitive tools for asset allocation, that have the following features:

- Forward-looking Analytics

By understanding what is embedded in prices, we can move beyond backward-looking tools and analysis.We construct return projections, risk distributions, and scenarios, that are entirely forward-looking. - Public & Private Asset Integration

When using a present-value approach, we can easily integrate listed equities, bonds, credit etc. alongside their private market counterparts, for a consistent total portfolio approach. - Macro-Based Risk Factors

Our present-value framework defines intuitive, economically meaningful factors, that can be used to explain, attribute, and manage multi-asset portfolio risks. - Quantify Investor Goals & Constraints

Our framework easily translates policy objectives, risk budgets, and constraints into explicit modelling inputs, so portfolios can be fully aligned with investor mandates. - Flexibility Across Assets & Markets

We use a single, adaptable framework that works across asset classes, regions, and market conditions — enabling decisions to stay consistent through changing regimes.

A new generation framework built on decades of R&D

Supported by a modern tech stack and analytics platform

Powerful and intuitive tools for all asset allocation problems

Modern and robust tech foundations

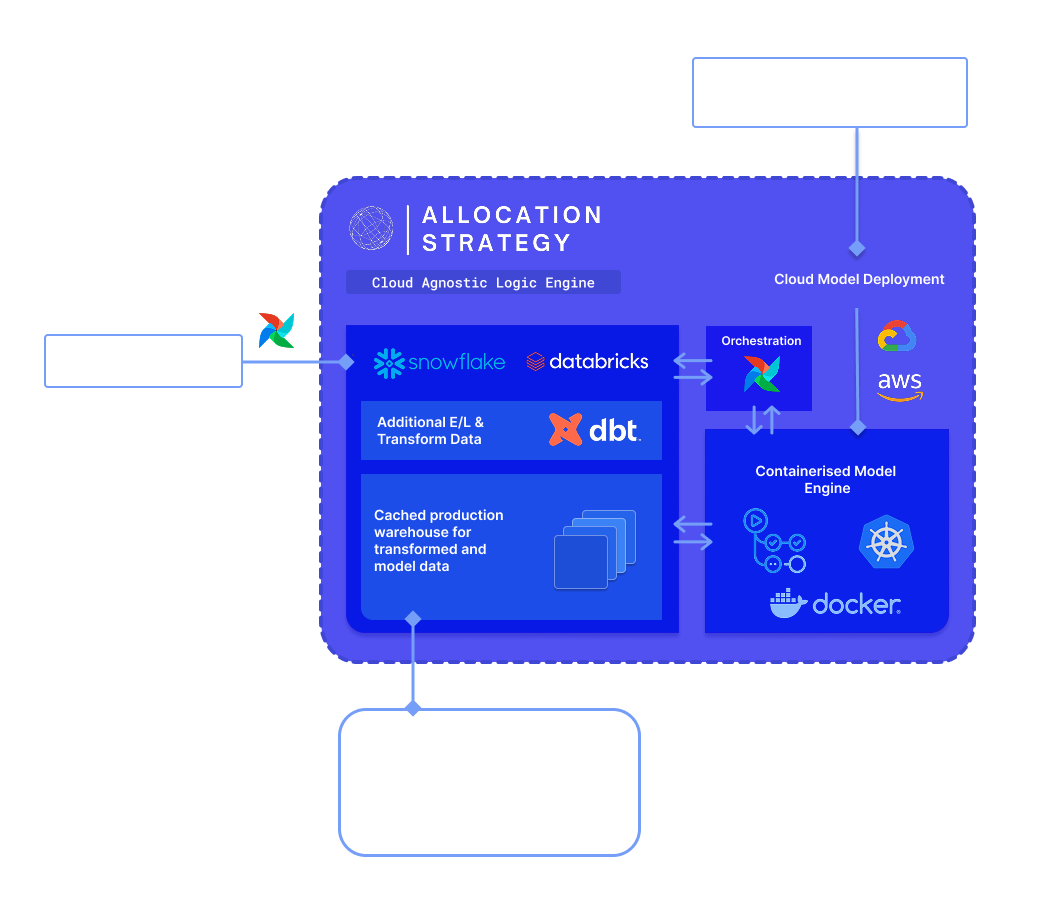

At Allocation Strategy, we invest heavily in our technology. Our platform is engineered from the ground up to combine scale, speed, and robustness. We use the latest tech frameworks and solutions to ensure that our systems are fully robust across data, model, and distribution stages.

Our cloud-agnostic architecture uses containerised analytics and automated deployment pipelines. This enables rapid iteration and seamless updates, making integration into client systems easy. Behind the technology is a production-grade data and modelling pipeline, combining high-quality raw data ingestion and high-performance infrastructure.

This integrated stack delivers fast, reliable, and reproducible analytics.