Market-implied Macro

Visibility into what's embedded in market prices

Market prices aggregate a rich set of information across a diverse set of investors. AS Market-implied Macro is a unique solution that systematically measures the consensus views and probabilities that are priced into markets.

We use advanced modelling techniques that combine market prices with options, futures, swaps, and survey measures to provide clients with visibility over what is priced across asset classes, across horizons.

We extract market-implied consensus views on expected dividend growth, inflation, real interest rates, equity risk premiums, term premiums, and option-implied probabilities that market participants assign to different outcomes. We infer short- and long-term views from a wide range of asset prices and financial instruments.

The estimates are available every day and delivered through modern tech platforms. Our estimates are used by a diverse set of financial professionals including CIOs, portfolio managers, researchers, and economists, who seek to understand what is priced into markets.

Key Facts

OPTION-IMPLIED PROBABILITIES

Market-wide assessments of probabilities across asset classes

We use carefully implemented, advanced modelling techniques to extract option-implied distributions and probabilities from markets. These allow us to read how investors collectively assess the likelihood of different outcomes across a wide range of asset classes and regions. This gives clients a uniquely rich and dynamic perspective on what’s driving market price movements — far beyond point estimates.

Granular coverage of over 70 equity market and sector indices, commodities, interest rates, and crypto assets

Delivered through modern, convenient channels including API, cloud, FTP, and standard formats like CSV and JSON

MARKET-IMPLIED CONSENSUS

Insights from ensuring market prices add up to their expected payoffs

Our advanced macro present-value modelling approach extracts the consensus macro expectations that are implicit in prices of equities, bonds, credit, and FX. By combining rich sources of information from a diverse set of financial instruments, we can separate market pricing across horizons for investors to understand what is priced over the short and long term, every day.

We extract information from asset prices, options, futures, swaps, and survey measures to provide granular visibility into what markets are pricing.

Our estimates provide clients with analytical tools to explore market pricing and decompose market moves across a wide range of asset classes and markets.

Applications

Carefully defined contrarian investing, and making sense of markets

We give investors the tools to carefully benchmark their contrarian views. Macro investors often think in terms of data surprises relative to consensus. Our analytics provide the means to explore how consensus expectations change across horizons and over time, and in response to news. This perspective is especially important for understanding and investing in long-duration assets.

Market pricing changes in response to changing market expectations and changes in probabilities attached to different outcomes. Our solution provides an enhanced understanding of why market prices change, through the lens of changing macro expectations, risk premiums, and probabilities.

- Benchmark views on growth at different horizons relative to what is priced into US equities.

- Understand duration positioning and whether views on long-term yields depend on reversion in monetary policy repricing, term premiums or other factors.

- Unpack volatility in Brent crude prices to understand how price changes have been driven by higher probabilities of an oil price spike in the next month.

Read more

Why are UK Gilt yields trading at high levels?

We discuss how UK yields have reached their highest levels in decades.

Macro consensus and understanding market-implied macro pricing

Applying DCF logic to extract market-implied expectations.

Estimating market-implied r-star in real time

Extracting consensus on the equilibrium rate consistent with market pricing.

Delivery & Analytics

Rich analytics and estimates of macro views implied by market prices

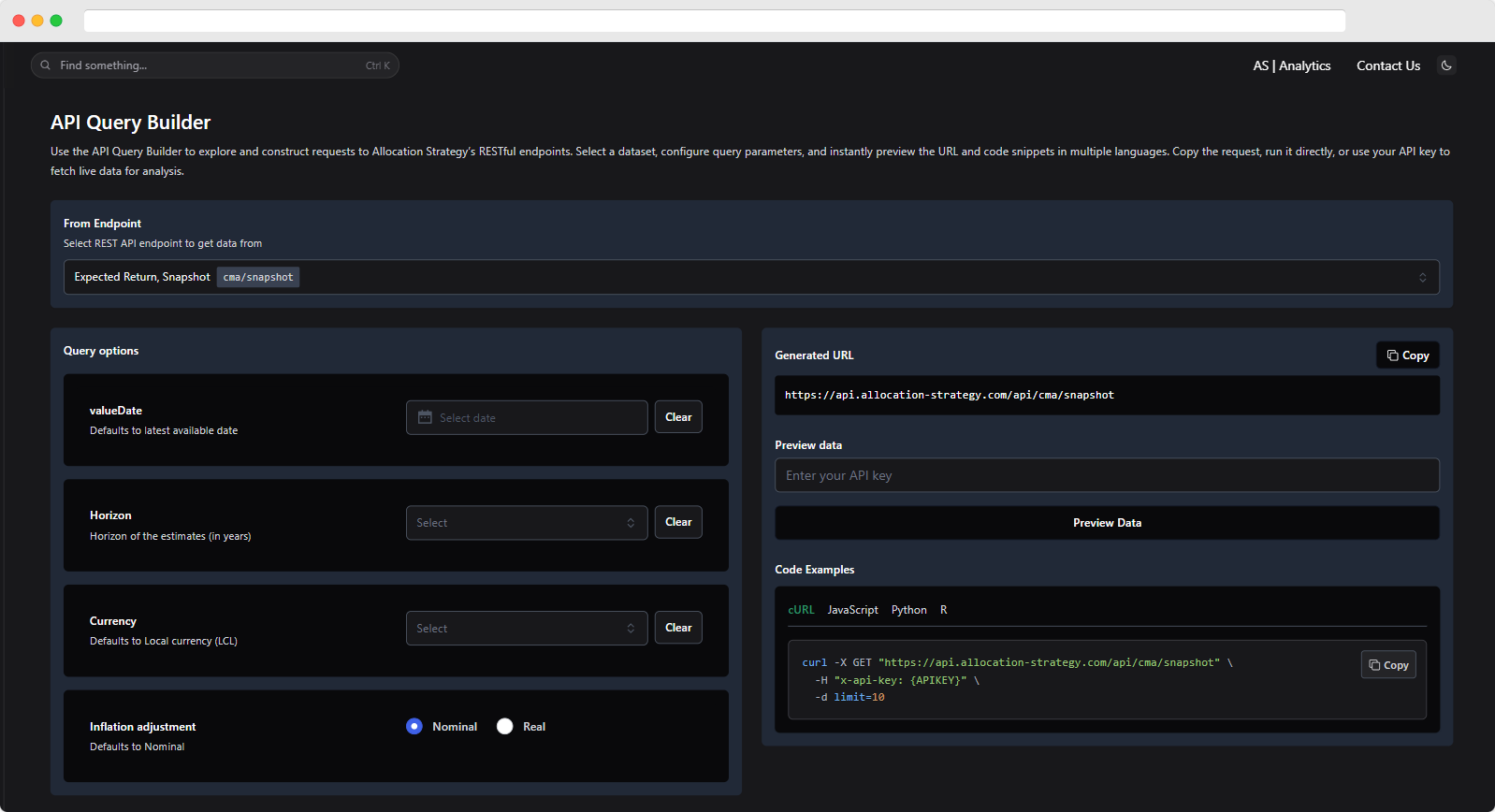

Available via API, with flexible delivery options including cloud and FTP — and an intuitive query builder that makes it easy to explore and retrieve exactly the data you need.

Expectations of dividend growth, inflation, real interest rates and risk premiums across markets and horizons

Decompositions of asset class performance into core macro drivers

Estimates of equilibrium real interest rates, inflation expectations, and long-term risk premiums derived from market pricing

Probabilities assigned to market outcomes across horizons implied by option prices