Capital Market Assumptions

New generation Capital Market Assumptions

Capital Market Assumptions are fundamental inputs for all asset allocation problems. AS Capital Market Assumptions are a new generation of expected returns, risk measures, and asset allocation tools. Our solution provides investors with advanced inputs and tools to enhance their strategic asset allocation decisions, quantitative risk analysis, and tactical strategies.

The expected return and risk estimates are produced using an advanced macro-present-value approach that combines options, futures, swaps, and surveys inputs. This forward-looking approach generates high frequency, accurate and timely estimates, that offer rich insights across investment horizons. Our solution is built on robust foundations and the latest academic thinking, which translates into intuitive tools that deliver real-world performance.

Our expected return and risk metrics are enhanced by key tools in the form of asset return paths, underlying macro variables, and scenarios. This package gives investors the confidence to build robust strategic asset allocations, and the means to build high-performing investment strategies.

Key Facts

Key Features

Return Prediction

Short-term estimates

AS CMAs span all horizons, including short term expected returns, and are valuable inputs into strategic and tactical asset allocation decisions.

Our short-term expected returns are demonstrated predictors of returns, and are produced within the same modelling framework as our long-term estimates. This gives investors a testable track record for the estimates.

Read more in Are your Capital Market Assumptions fit for purpose?

Flexibility

Tailored perspectives

Tailor your analysis of expected returns and risk by selecting horizons from 1 to 30 years ahead, choosing different currency perspectives and nominal and real terms, updated every day.

Delivery

Modern tech stack

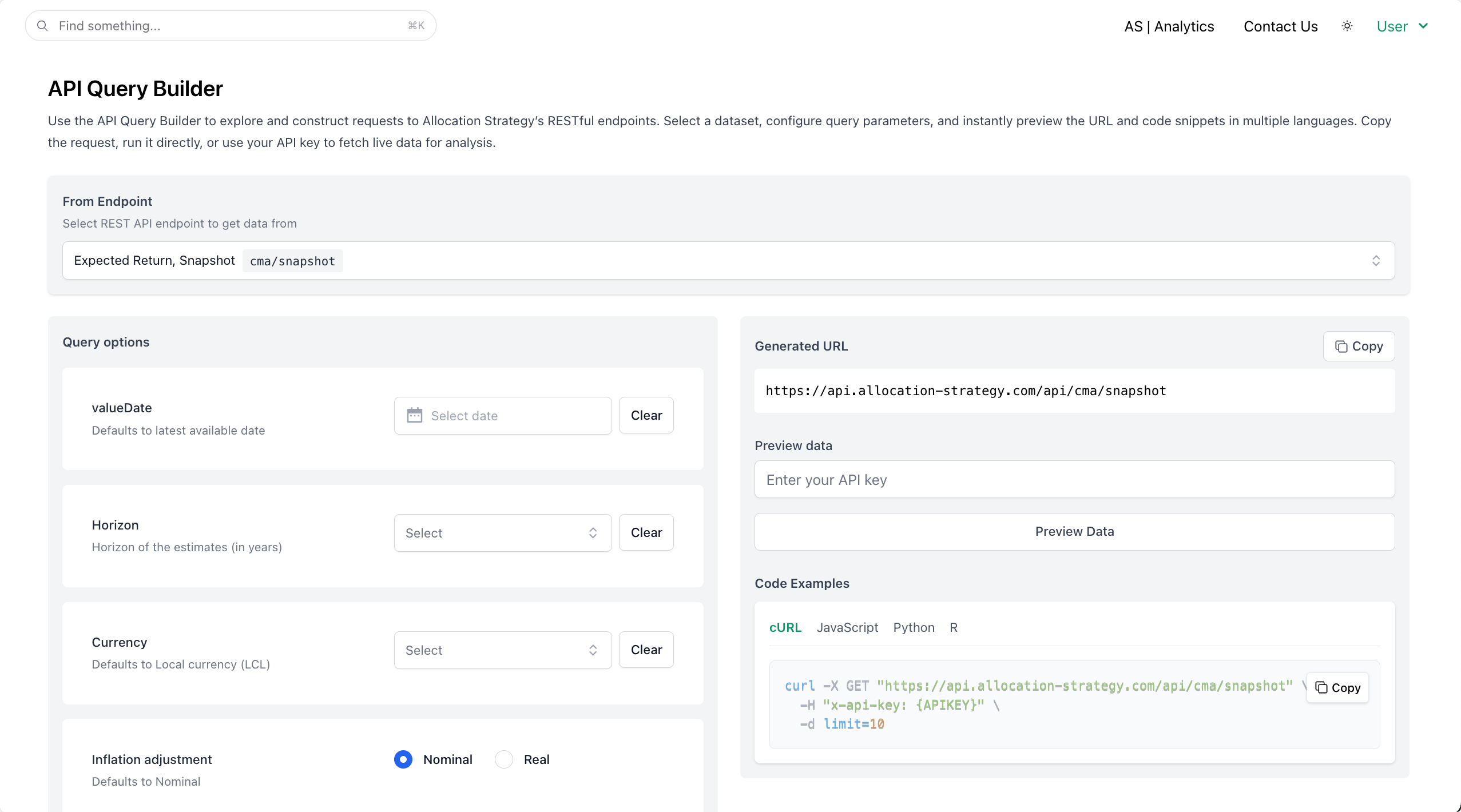

All Capital Market Assumptions data are made available through API, cloud, and FTP delivery. Our API site provides clear guidance on data including an API query builder for multiple programming languages.

Applications

How AS Capital Market Assumptions Add Value

AS CMAs provide comprehensive visibility on investment opportunities and risk, helping investors construct and maintain robust and optimal asset allocations and portfolios. Detailed return perspectives allow investors to tailor estimates over horizons from 1 to 30 years ahead, adjusting for different currency perspectives and nominal and real terms, every day.

- Refine strategic asset allocations

- Asset owners, boards, and investment committees need the best tools in hand to determine how to allocate for the long-term. Combine our advanced and comprehensive expected return and risk measures with return paths and scenarios to build tailored and resilient asset allocations.

- Enhance tactical and dynamic strategies

- Short-term expected returns are valuable signals for portfolio managers, strategists, and researchers to implement tactical positioning.

- Stress-test your allocations

- Use our unique tool to design your own scenarios to understand how expected returns change in different market and macro conditions, plus analyse any strategy and the full distribution of outcomes using return paths

- Respond quickly and confidently during market stress

- React quickly and with clarity to market sell-offs and changing investment opportunities with daily updates.

Read more

Using CMAs to navigate the recent equity market sell-off

Did our expected returns anticipate subsequent performance across markets?

What is the expected return on gold?

The macro drivers of Gold and its role in multi-asset portfolios

Breaking down yields for asset allocation in volatile bond markets

Short- versus long-term perspectives and forecasting bond returns.

Coverage

Comprehensive coverage of globally investible asset classes, markets, and segments

Kingdom

Markets

Corporate

bonds

bonds

bonds

Kingdom

Developed Markets

Markets

Gov. Bonds

Corporate Bonds

Corporate

bonds

bonds

bonds

Contact Us

Find out more

Contact us to learn more about how we can help with your asset allocation needs.

Learn more