Model Portfolios

Systematic, analytics-driven multi-asset portfolios built for performance and resilience.

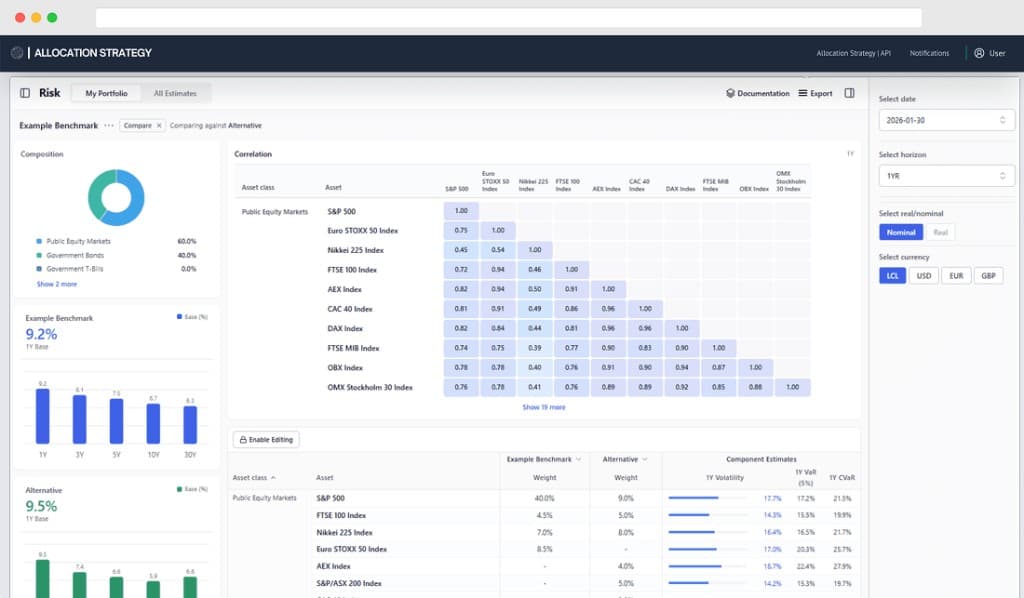

Multi-asset portfolios powered by the full analytics suite

AS Model Portfolios draw on the full Allocation Strategy analytics suite — expected returns, risk measures, and scenario analysis — to construct multi-asset portfolios with a total-portfolio perspective across asset classes. Every allocation decision is systematic and analytics-driven.

The result is portfolios that are powerful, high-performing, and resilient across changing market regimes. Allocation decisions are intuitive, guided by economic drivers, and avoid “black-box” approaches — every position has a clear, documented rationale that stands up from a governance and communication perspective.

We provide wealth managers and institutional investors with explicit asset weights and a logical progression of risk across profiles. We provide supporting presentation material for internal and external use. The portfolios are delivered through modern platforms for wealth managers, CIOs, and portfolio managers who seek an advanced asset allocation approach.

STRATEGIC & TACTICAL ALLOCATION

A coherent, layered approach to building portfolios

We take a layered approach to building model portfolios. Our asset allocation analytics provide the foundation — expected returns, risk measures, and scenario analysis across asset classes. From there, we either adopt a client benchmark or construct a strategic allocation at a given horizon, weighing up risk-return prospects across a wide range of asset classes and segments.

Tactical adjustments are then layered on top to exploit shorter-term opportunities. These can be driven by relative expected return signals, specific macro or market scenarios, or targeted tactical views — allowing portfolios to respond to changing conditions without compromising the strategic foundation.

Portfolio Evaluation

Assess return and risk across horizons, currencies, and inflation perspectives

We evaluate model portfolio return and risk across multiple horizons, in different currency perspectives, and in both real and nominal terms. This gives wealth managers and institutional investors a complete picture of how portfolios are expected to behave under different conditions and time frames.

Scenario analysis is used to understand the drivers behind model portfolio construction — and to explain to advisors and clients the rationales and risks embedded in each allocation decision. This supports governance, client communication, and the ability to respond confidently when market conditions change.

Flexibility

Tailored to your mandate and constraints

Model portfolios can be configured to reflect different mandates, benchmarks, and investment constraints. Whether the objective is to track benchmark risk closely or to express stronger conviction across asset classes, the framework adapts to each client’s requirements.

- Benchmark alignment and risk-matching across volatility, drawdown, and other measures

- Investable universe customisation: commodities (including gold), private assets, property, sectors, emerging markets, small/mid-caps, nominal vs. inflation-linked

- Position-sizing constraints and turnover targets tailored to each mandate

- Horizon-specific evaluation of risk and return, configurable by fund