Asset allocation through the rear-view mirror?

Estimating expected returns and risks attached to different asset classes or portfolios is usually done with the help of models estimated using historical asset returns. Realised asset returns are noisy and extracting expected returns from them requires a series of strong assumptions which tend to be empirically invalidated. For example, reliance on historical returns is problematic when there are secular changes in the global economy – which empirically is undoubtedly the case.

Expected returns

The estimation of expected returns using historical data relies on the logic of “mean reversion”, i.e., assuming that economies and markets always revert to a stable equilibrium, which in turn can be estimated from historical data. Such an assumption is invalidated in a world that undergoes structural shifts, where key macroeconomic variables characterizing these shifts—such as GDP growth potential, the equilibrium real interest rate, and long-term inflation expectations—evolve over time. In such a world, asset class returns at long horizons are largely determined by macro trends alongside risk premiums.

A good illustration of the importance of macro trends is the episode from the 1980s to the Covid-19 pandemic during which government bonds delivered exceptional returns. These extraordinary gains were largely driven by secular declines in real rates and inflation expectations. A model of expected returns that relies on historical returns would incorrectly infer that high returns on government bonds are set to continue.[1] The estimation of expected returns gets more complicated for other asset classes such as equities whose returns are exposed to additional macro drivers.

Risk

It is also problematic to assess portfolio risk using models that are estimated or calibrated using historical returns and assume stable regimes. The relative performance of asset classes and the correlation structure of their returns vary by macroeconomic regime, with the differences being driven by macro drivers. Risk models that lean on historical returns are bound to mischaracterise the correlation structure of future asset class returns.

Even though these issues might matter less at short horizons, they are first order for modelling longer term risk, where the correlation structure of macro drivers matters much more. For example, the risk of a stagflationary regime is small at short horizons but increases with an expanding horizon. A model of risk estimated on historical returns over a period that does not include stagflation will inevitably underestimate the risk of stagflation.

Forward-looking risk and return

Our approach to modelling risk and expected returns on asset classes, portfolios and investment strategies always aims to be forward-looking. While we draw on historical data, we try hard to avoid the pitfalls associated with reliance on historical asset returns.

First, we estimate expected returns on asset classes using forward-looking data: by combining asset prices, derivatives and surveys in a present-value framework. In our present-value framework, we establish links between asset class returns and macroeconomic outlook in historical data which gives us a decomposition of asset class returns into macro drivers. Return decomposition is instrumental in uncovering structural relationships between returns and changing expectations about macroeconomic outlook and movements in risk premiums. These relationships are derived from the present-value logic and are stable across regimes.

The second step involves simulating the macro environment together with a careful modelling of investors’ expectations at each point in time. Our simulation model is calibrated using the structural relationships between asset returns and macroeconomic outlook derived from the present-value logic and uses the current market consensus as a starting point. Pairing it up with mapping of asset class returns to macro drivers delivers simulated prices and returns on a full range of asset classes, portfolios and investment strategies. The simulated distributions are the basis for computing a full spectrum of risk measures that can be customized to investor’s needs. They also tell us about how initial expected returns estimates can evolve over time. Importantly, the simulated returns are consistent with current market pricing and their correlation structure is linked to the macro environment in a consistent way.

Macro trends and regime risk

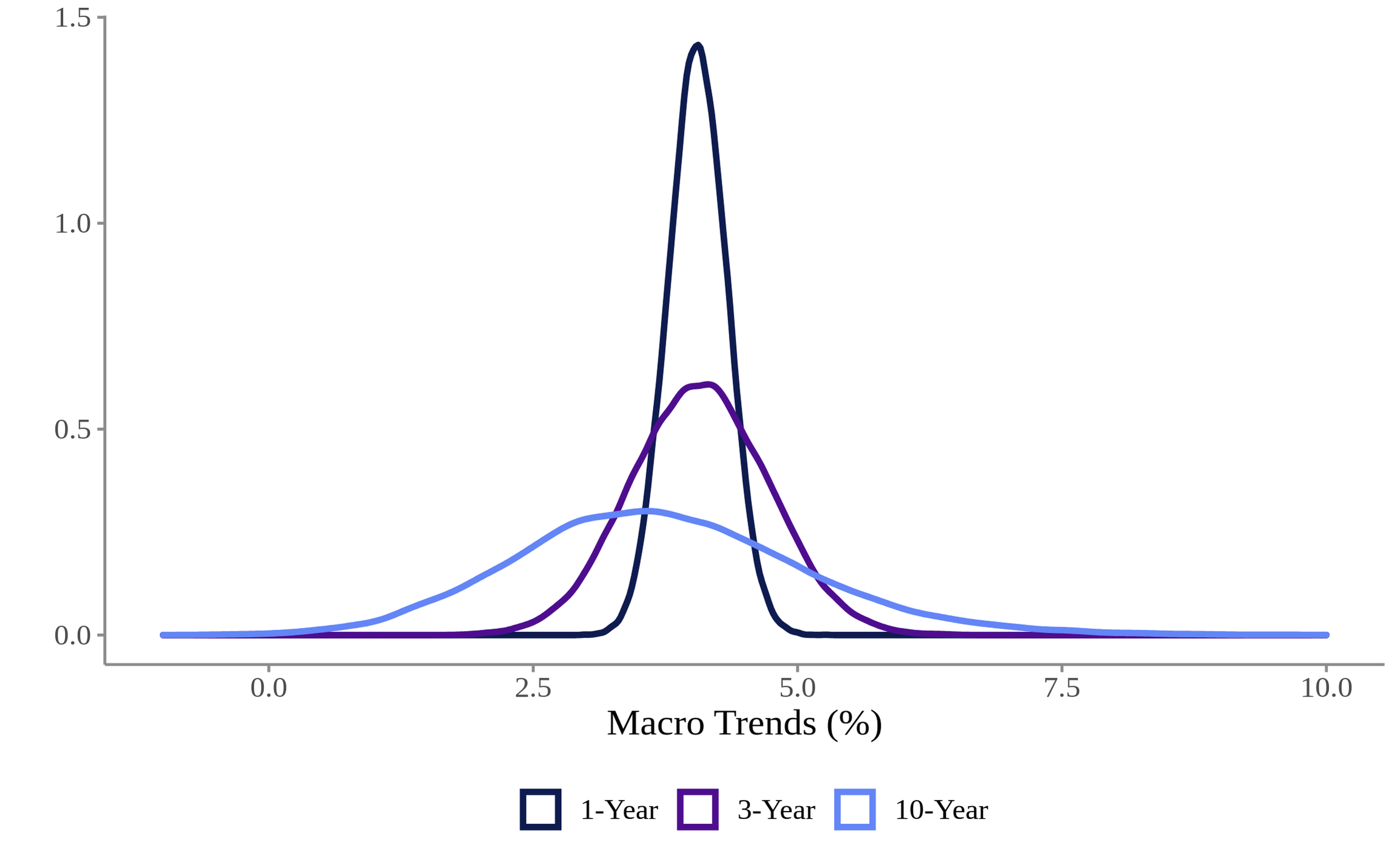

Macro and policy outcomes, and risks associated with them, largely determine portfolio risk. This is especially so at longer horizons, where transitory risk premium variation plays a smaller role. The risk associated with macro trends, whose importance grows with increasing horizon, is perhaps the most important risk to represent accurately in the simulation model. For example, a realistic model of long-horizon fixed income returns should assign a non-negligible probability to a return of double-digit nominal yields last seen during the “Volcker period” but also to a “deflationary scenario” experienced by Japan in the decades before the Covid-19 pandemic. Figure 1 below illustrates this point by showing that the range of potential macro outcomes grows with the increasing horizon. At long-horizons the potential inflation/growth outcomes indeed range from deflationary environment to stagflation. Generating such realistic distributions is a challenge for most of available risk models.

Figure 1: Distribution of macro trends across horizons

The chart shows the distributions of the sum of long-term inflation expectations and long-term growth expectations across horizons. The distributions are generated by our proprietary simulation model which is part of ASAMM.

The fact that the range of potential macro outcomes changes drastically across horizons indicates how much the risk-return trade-off changes across horizons. By modeling the full term structures of expectations and discount rates, we can capture the risk-return trade-off at any horizon. This opens up the possibility of using our forward-looking modelling approach not only for strategic asset allocation, which primarily focuses on long-horizon investment outcomes, but also for tactical asset allocation.

Interested in finding out more? Use our contact form to continue the discussion.